#

2- What is the size of the market opportunity, and what is the company's addressable market?

The market size of the digital subscription economy worldwide amounted to 650 billion U.S. dollars in 2020. That year, subscriptions to cloud services accounted for roughly 45% of the market, with an estimated value of around 292 billion U.S. dollars. Meanwhile, the market size of the e-commerce segment was forecast to reach 687 billion U.S. dollars by 2025. Source*

#

Breakdown

#

The market size of the digital subscription economy

- The market size of the digital subscription economy worldwide was 650 billion USD in 2020.

- The market is forecasted to reach 1,500 billion USD by 2025.

#

Segments of the digital subscription economy

- Cloud services accounted for 45% of the market in 2020.

- The E-commerce segment is forecasted to reach 687 billion USD by 2025.

- Other segments are forecasted to reach 277 billion USD by 2025.

#

Subscription programs in the travel industry

- The share of adults subscribing to travel subscription programs globally in 2021 varies by country, gender, and age.

- Benefits that would motivate adults to subscribe to travel programs in the U.S. in 2021 include discounts, exclusive deals, and personalized recommendations.

#

Hotel subscription memberships

- The share of hotels offering subscription memberships worldwide in Q2 2021 was 14%.

- Main hotels' distribution strategies to sell new non-room products worldwide in Q2 2021 include loyalty programs and partnerships with travel companies.

#

Digital subscription economy overview

- Market share of the digital subscription economy worldwide in 2020 by region varies from 33% in North America to 22% in Asia-Pacific.

- The market share of the digital subscription economy worldwide in 2020 by sector varies from 45% in cloud services to 14% in e-commerce.

#

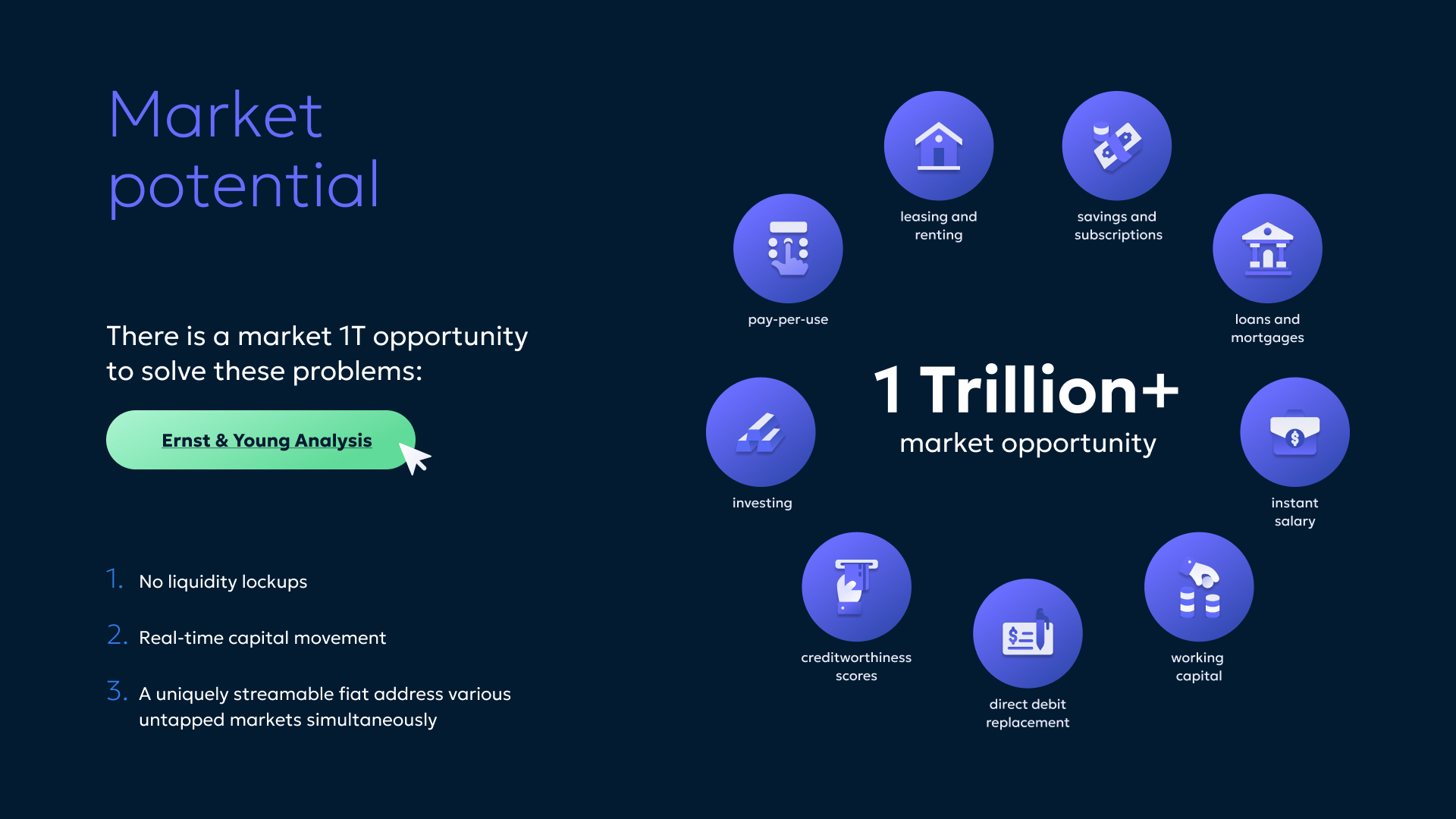

Another interesting market opportunity is offered by Pay-On-Demand.

According to E&Y e&y on-demand pay 2020, On Demand Pay is a $1T opportunity. This is in fact the amount of money accrued in employer payroll accounts on any given day. Streamable Finance solutions can have a prominent role in allowing employers to provide employees access to this liquidity and, in doing so, create meaningful societal utility at a limited frictional cost.

The main use case for On-Demand Pay is that of everyday financial pressures, which we have found to be widespread: 70% of individuals in the UK and the US experience financial stress regularly. Half of these individuals have faced a financial shortfall between pay periods and encounter this issue approximately every four months.

The negative impacts for individuals are considerable:

nearly 75% of those who have experienced financial difficulties have reported material deterioration in their health and well-being.

When this stress is carried into the work environment it manifests as a distraction, absenteeism, reduced performance and ultimately employee turnover. 20% of employee turnover is attributable to financial stress, and E&Y estimates the combined effect of this to cost employers in the US and the UK c.$300B annually.

However, it is important to note that On-Demand Pay solutions can offer utility not just to lower earners or individuals of lesser financial means. Access to earned income can give all employees far greater control over their finances by enabling them to align income with expenses more effectively, allowing better budgeting and supporting their financial well-being.

#

We are beginning to see evidence of consumer appetite:

80% of individuals in our research have indicated they would use a form of On-Demand Pay. Moreover, the range of reasons consumers would like to access their pay is wide, spanning emergencies, budgeting and savings.

Whether the full potential of On-Demand Pay is realized will depend on several factors, such as an accommodating regulatory environment, alignment with employer priorities and consumer adoption. What is clear is that it offers a compelling economic case for employers and materially better financial outcomes for employees when compared to the many alternative financing options.